Budget 2019 will separate EPF from life insurance reliefs. 20182019 Malaysian Tax Booklet 12 Relief for error or mistake or inaccurate tax returns Application for relief can be made to the Director General of Inland Revenue DGIR for tax returns which are incorrect due to the following reasons.

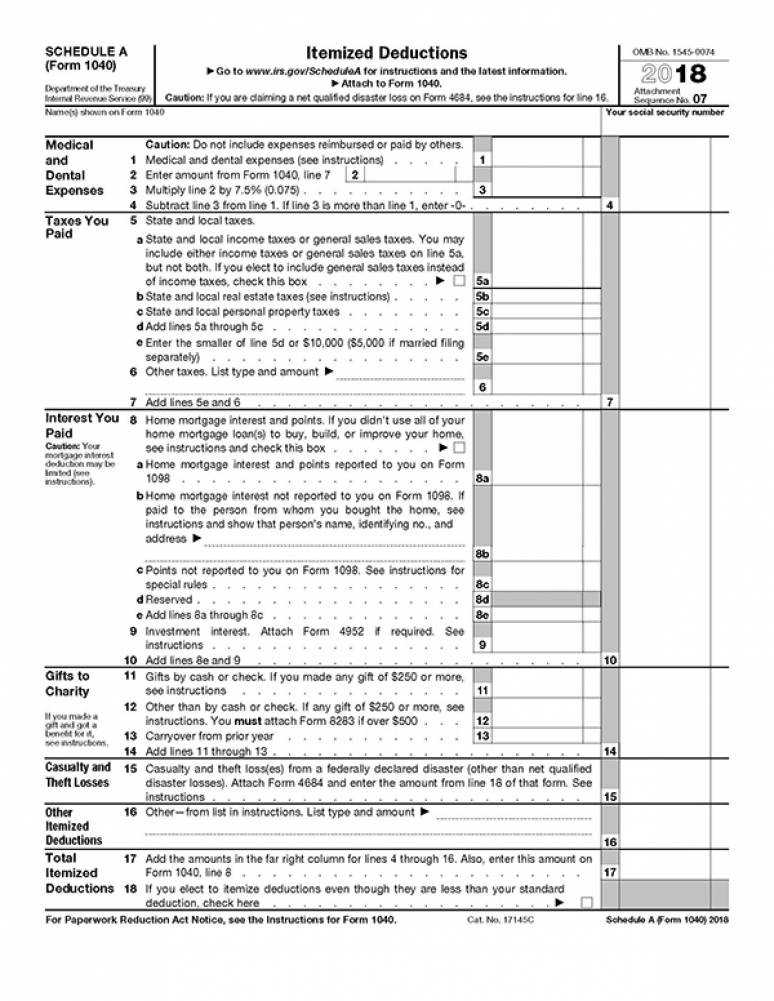

2018 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Government Bookstore

However any amount that is withdrawn after your first deposit in 2018 is not counted.

. Medical Expenses for Parents OR Parent Limited 1500 for only one mother Limited 1500 for only one father 5000 limited OR 3000 limited 3. For example lets say your annual taxable income is RM48000. This would enable you to drop down a tax bracket lower your tax.

You will not be taxable if Employed in Malaysia for less than 60 days Employed on board a Malaysian ship Age 55 years old and receiving pension from Malaysian employment Receiving interest from banks Receiving tax exempt dividends If. Previously the tax relief of EPF and life insurance takaful was a combined total of RM6000. 1 There is also an increase in real property gains tax rates for disposals in the 6 th.

Calculations RM Rate TaxRM 0 - 5000. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Malaysias Minister of Finance presented the 2019 Budget proposals on 2 November 2018 offering some increase in personal tax reliefs and a reduction in contributions to the Employees Provident Fund for individuals above the age of 60.

About This Malaysian Personal Income Tax Calculator. It should be calculated as the total deposit in the year 2018 MINUS total withdrawal in the year 2018. When to Use This Calculator Once you know what your total taxable income is You want to work out the tax on that taxable income.

EPF contributions tax relief up to RM4000 Life insurance premiums and takaful relief up to RM3000. Based on this amount the income tax to pay the government is RM1640 at a rate of 8per cent. Personal relief is allowed as a deduction from the total income of an individual in arriving at chargeable income.

This personal income tax calculator will work out tax rates obligations and projected tax returns and also tax debts for certain cases. Types of Contribution allowed for Personal Tax Relief Individual Relief Types Amount RM 1. Personal income tax in Malaysia is charged at a progressive rate between 0 28.

There are personal reliefs that every taxpayer in Malaysia can deduct once their income reaches the chargeable income level. 20182019 Malaysian Tax Booklet 12 Relief for error or mistake or inaccurate tax returns Application for relief can be made to the Director General of Inland Revenue DGIR for tax returns which are incorrect due to the following reasons. This relief is only available to a Malaysian tax resident.

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. If you have deposited money into your SSPN account in 2018 then this amount can be claimed in your e-BE form as well. And ii PR No.

13 rows Malaysian ringgit A non-resident individual is taxed at a flat rate of 30 on total taxable income. March 10 2022 For income tax in Malaysia personal deductions and reliefs can help reduce your chargeable income and thus your taxes. If planned properly you can save a significant amount of taxes.

Personal Tax relief changes Income tax reliefs will see some adjustments too. Reasons Time frame Error or. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500.

Purchase of personal computer for individual allow once in 3 years RM3000 Resident individual in Malaysia entitles to claim tax relief deduction and rebate Tax Relief Tax Deduction Housing loan interest RM10000 fulfill the requirement TAX DEDUCTION RELIEF AND REBATE Year of Assessment 2009 LHDNM-R00710 Junaidi Caw. Generally an individual is considered a tax resident if heshe is. 52018 titled Taxation Of A Resident Individual Part II Computation of Total Income and Chargeable Income.

This relief is applicable for Year Assessment 2013 and 2015 only. In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will now be taxed 3 8. Assessment Year 2018-2019 Chargeable Income.

Self Dependent 9000 2. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. 62018 titled Taxation Of A Resident Individual Part III Computation of Income Tax and Tax Payable which can be obtained from the official portal of the Inland Revenue Board of.

Reasons Time frame Error or. Basic supporting equipment for disabled self spouse child or parent 6000.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Income Tax Malaysia 2018 Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Joint And Separate Assessment Acca Global

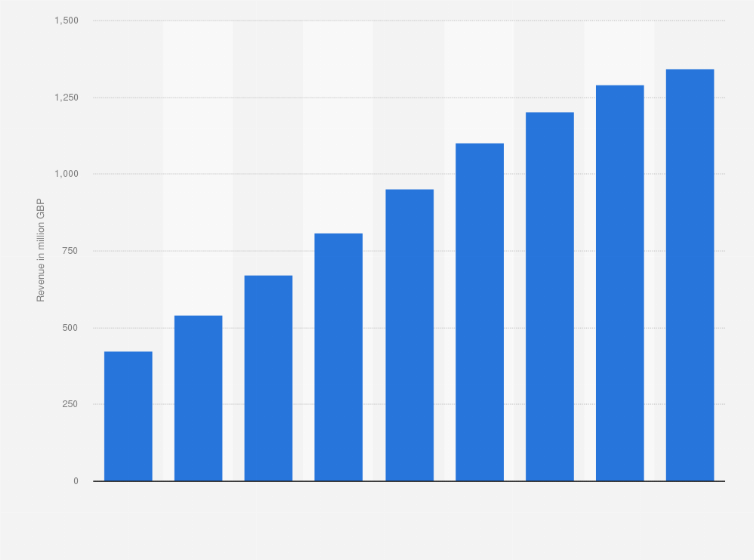

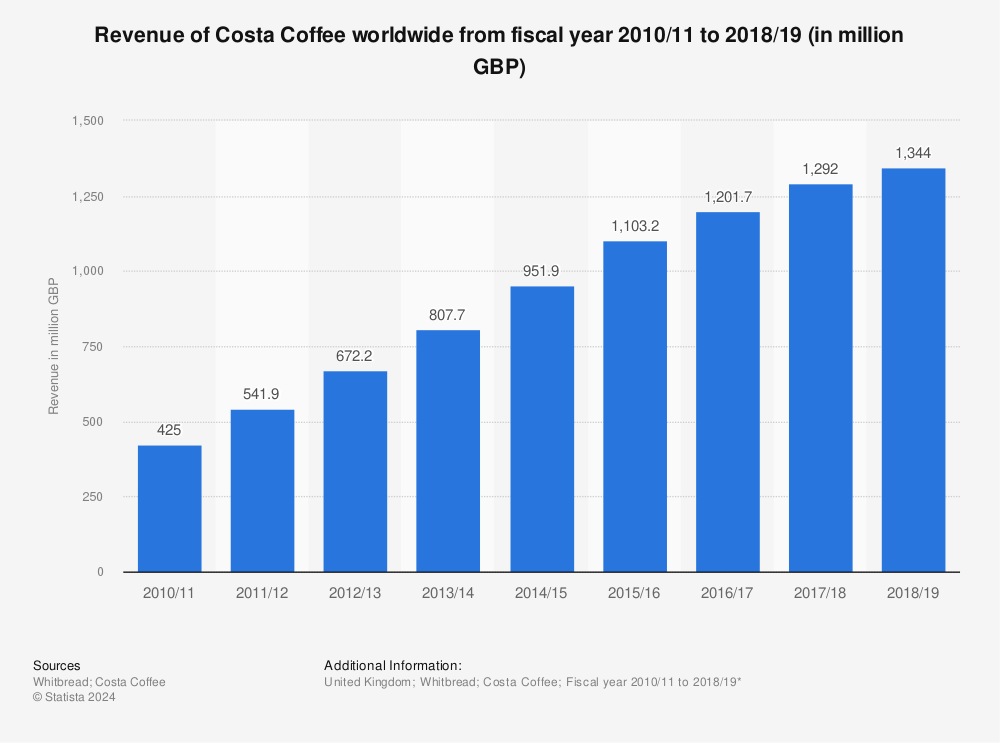

Costa Coffee Revenue 2010 2019 Statista

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Costa Coffee Revenue 2010 2019 Statista

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

21 Tax Reliefs Malaysians Can Get Their Money Back For This 2019 World Of Buzz Relief Tax Money

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

Do You Need To File A Tax Return In 2018

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Latest Tds Rates Chart For Fy 2018 19 Ay 2019 20 Tax Deducted At Source Tax Budgeting

Here Are The Tax Reliefs M Sians Can Get Their Money Back For This 2018 World Of Buzz Tax Relief Income Tax